Divided co-ownership: understanding the description of the private portions

By law, co-ownership syndicates must draw up a description of the private portions of their buildings. Here are 8 Q&As to help you understand this requirement.

1- What is a private portion?

The private portion usually corresponds to a co-owner's condo unit and is therefore part of the building. For example, it includes the unit's walls, floors and ceilings. It may also include the cabinets and basic equipment included in the unit such as the bath, sink and kitchen cabinets, as well as personal property that is a permanent fixture.

2- What is the description of the private portions?

It is a document that describes a standard unit before improvements are made by the co-owners. All the elements not included in the description are considered improvements. It serves to establish what constitutes an improvement to a private portion and what does not1. The standard unit must be insured by the syndicate, while improvements must be insured under the co-owner's home insurance. In the event of a loss, it makes it easier to determine who pays: the syndicate's insurance or the co-owner's insurance.

3- Why require a description of the private portions?

The description of the private portions is a document that is part of the co-ownership register, in the same way as the Declaration of Co-Ownership, the building by-laws and the financial statements. Since June 13, 2020, all co-ownership syndicates must make this document available to the co-owners of their building.

4- Who draws up the description? The syndicate or each co-owner?

The syndicate is responsible for drawing up the description of the private portions, as provided for under the Civil Code of Quebec. However, the co-owners' collaboration is essential for approving and completing the final description, especially for co-ownerships that are not new builds.

5- What must the description of the private portions include?

The syndicate insures the immovable portions of the unit. The legislation does not stipulate which elements must be included in the description. Consequently, the syndicate may decide to describe the unit as it is today, or it may decide to describe it as it was when it was built.

6- What should be done if the co-ownership units are not all identical?

There may be one or more descriptions in the same co-ownership building.

The syndicate may draw up:

- a description for each unit

- a description for all similar units

- a single description for all the units

The description then becomes the standard, and what is not included will be considered

an improvement covered by the co-owner's insurance policy. It is therefore important that the syndicate and the co-owners have sufficient insurance to cover the elements they are responsible for insuring.

7- After completing the description, what must the syndicate do?

The syndicate must make sure the description is approved at a co-owners' meeting in accordance with the by-laws. Once approved, it must be kept with the other co-ownership documents: plans, specifications, declaration of co-ownership, etc. It must be available to all co-owners who ask to consult it and must be included in the co-ownership register. Insurers may need it when purchasing insurance or in case of loss.

8- Does the description have to be modified if a co-owner makes changes to his unit?

In principle, no. The description is a “snapshot” of the unit at a given time, as decided by the syndicate. Changes made by a co-owner which add value to the unit will generally be considered improvements as they will not be included in the description of what is considered the standard unit.

However, if the changes made modify the standard initially established, the description of the private portions must be modified and the changes included in the private portion. The modifications will not be considered improvements. Note that any change to the description of the private portions must always be approved by all the co-owners.

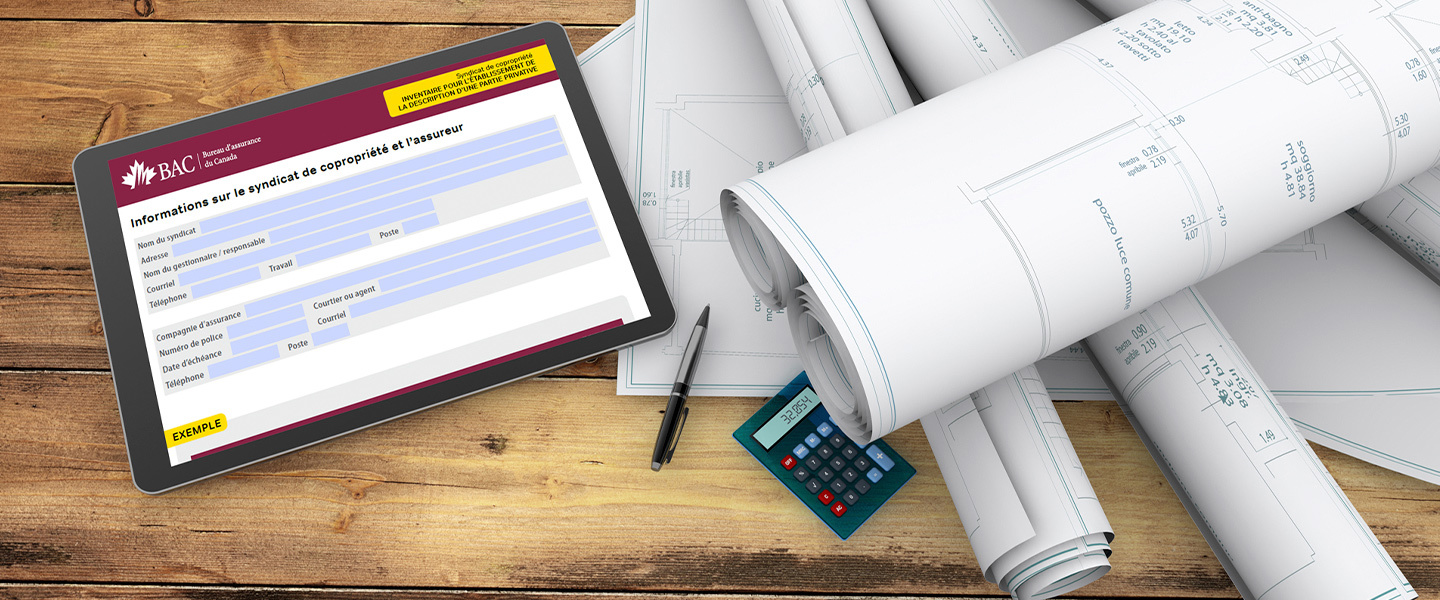

Insurance Bureau of Canada has made a tool available to syndicates to help them draw up a description of the private portions of their building:

Inventory for establishing the description of a private portion

1 When not mentioned in the description of the private portions drawn up by the syndicate, improvements are work done on or expenses incurred for personal property or in a unit by the co-owner or his predecessors, and which generate added value. The work done or expenses incurred increase the value of the personal property or of the unit compared to its original value. This may include the replacement of materials or replacing layouts by better quality or more expensive ones. It may include the addition of new materials or layouts.

2 An Act mainly to improve the regulation of the financial sector, the protection of deposits of money and the operation of financial institutions.

co-ownership syndicate

condo insurance