When your vehicle is a total loss

Why doesn't your insurance indemnity cover the total cost of a replacement vehicle?

This article is for you if:

- You had an accident and your vehicle is a total loss, or your vehicle has been stolen.

- Your insurance contract includes Q.E.F. Endorsement No. 43 and option 43E1;

- The amount paid by your insurance company does not cover the full cost of the replacement vehicle;

and you would like to understand why.

Here are two possible reasons:

- Your dealer's price includes credit charges2. Endorsement 43 does not cover these charges.

- You borrowed money to pay for the damaged vehicle, and you are still paying off the loan.

To make things clearer, let's look at the details.

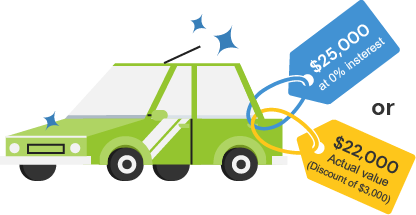

1. Your vehicule is a total loss

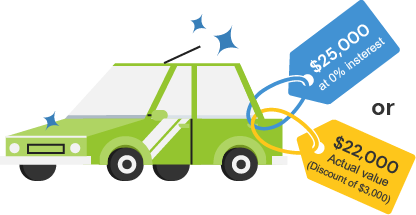

2. You purchase a replacement vehicule

Real value of the vehicule $22,000

Your dealers offers the following choices

$25,000 at 0% interest

$22,000 cash down (a $3,000 rebate)

Although the interest rate is 0%, the vehicule is sold at a price higher than its real value ($20,000). The $3,000 difference is a credit charge, and these charges are not covered by Endorsement 43.

$22,000 is the real value of the vehicule.

3. Your insurance company pays you an indemnity

Regardless of how your purchase is financed, your insurer will pay only the real value of the vehicule($22,000 in this example).

Under any other system, people who chose 0% dealer financing would receive a greater indemnity ($25,000) than people who paid cash ($22,000), wich would be unfair.

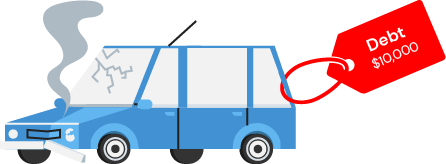

1. Your vehicule is a total loss

2. You purchase a replacement vehicule

Real value of the vehicule $22,000

Your dealer offers the following choices

$25,000 at 0% interest

$22,000 cash down (a $3,000 rebate)

Votre choix

You choose to pay $25,000 at 0% interest

3. Your insurance company pays you an indemnity

The insurer pays $22,000 (which is the real value of the vehicule). This is how the indemnity is spent.

$10,000

is used to pay off the loan on the vehicule that is a total loss

$12,000

is given to the dealer to cover part of the cost of a new vehicule

You must pay the dealer an additional $13,000 to purchase a vehicule for $25,000, this includes a $3,000 credit charge.

The credit charges is the equivalent of an interest rate of 17.92% over three years.

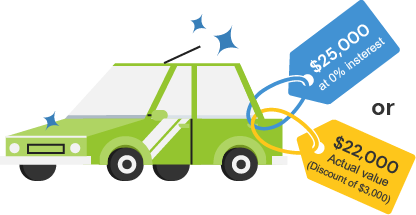

1. Your vehicule is a total loss

2. You purchase a replacement vehicule

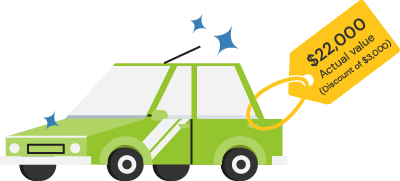

$22,000 is the real value of the vehicule.

Choix proposés par le concessionnaire

$25,000 at 0% interest

22 000$ cash down (a $3,000 rebate)

Your choice

You choose to benefit from the $3,000 rebate by paying the dealer cash down with money borrowed from the bank.

3. Your insurance company pays you an indemnity

The insurer pays $22,000 (which is the real value of the vehicule).This is how the indemnity is psent.

$10,000

is used to pay off the loan on the vehicule that is a total loss

$12,000

is given to the dealer to cover part of the cost of a new vehicule

You must pay an additional $10,000 to purchase the vehicule.

Ifyou take out a bank loan at 6% interest over three years, you will pay a total of $22,951.92 for the vehicule. The credit charge you pay will be $951.92 (instead of $3,000 with 0% financing).

Questions?

Contact our Information Centre.

Useful links:

Protégez-vous website (in French):

https://www.protegez-vous.ca/Nouvelles/Automobile/votre-pret-auto-est-il-vraiment-a-0

1 This endorsement says that you are entitled to an indemnity equal to the value of a replacement vehicle, new or used, that has the same characteristics, equipment, and accessories as the vehicle that is a total loss.

2 Information (in French) from the Office de la protection du consommateur:

https://www.opc.gouv.qc.ca/commercant/secteur /vehicule/publicite/regle/renseignement/.

auto insurance

total loss

endorsement 43

claims