Why does my home insurance cost more?

Your home insurance is costing you more and you're wondering why. Here are 3 reasons.

1- Rising costs of losses

We insure our property so that it can be repaired or replaced if we suffer a loss. The cost of losses thus has a direct impact on the cost of our home insurance.

Year after year, the cost of replacing damaged property and repairing or rebuilding a home is increasing. The cost includes not only the property itself, but also the cost of materials and labour necessary to restore a home.

Sources : Insurance Bureau of Canada, CatIQ, 2023

For example, repairing a home in Quebec after a fire cost an average of $129,584 in 2022, an increase of 46% in five years. During the same period, the cost to repair a home after water damage increased by 32%, rising to $14,887 in 2022. Such increases inevitably affect the cost of home insurance.

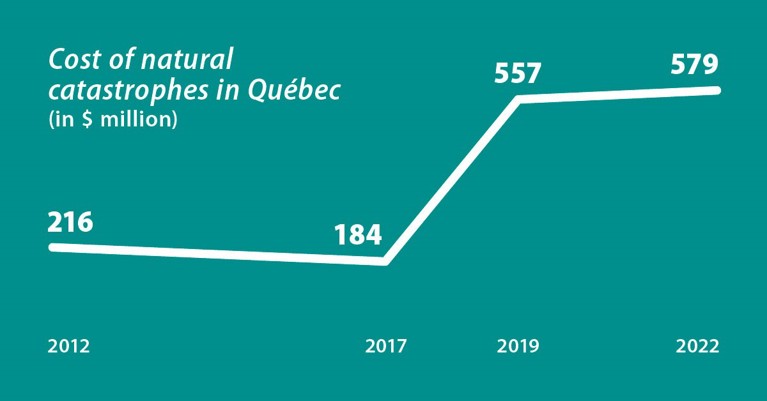

2- Insuring against natural catastrophes has a price

Heavy rain, high winds, tornadoes, ice storms, forest fires—all of these events have a direct impact on the cost of home insurance. Such catastrophes are increasing in frequency, sparing no region and affecting all policyholders. In Québec in 2022, the cost of such natural catastrophes insurers paid out nearly $580 millions for damage caused by natural catastrophes.

Sources : Insurance Bureau of Canada, CatIQ, 2023

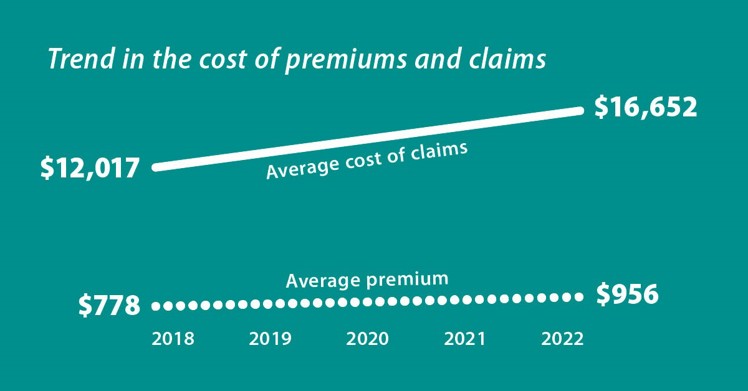

3- Premiums required to pay losses

In Quebec, people paid an average of $956 to insure their houses, condos or apartments in 2022. However, when a loss occurs, it costs insurers an average of $16,652 to compensate us. Do the math: That's more than 17 times the amount paid individually!

How do insurers make ends meet? The premiums paid by all of an insurance company's customers are used to compensate those who suffer losses. That's how insurance works. The increase in the cost of claims and premiums ends up affecting all policyholders.

Sources : Insurance Bureau of Canada, CatIQ, 2023

If you're unhappy with the cost of your insurance, there are several simple things you can do to pay less.

home insurance

claims

premium

extreme weather events